Penalties and fascination accrue: If you end generating payments with your debts, you’ll most likely experience money penalties like late charges. You may additionally accrue fascination, increasing the general quantity you owe.

Transfer your credit card debt into a stability transfer card or personal loan with a lower fascination fee — enabling you to definitely center on just one regular payment

A personal loan EMI calculator helps you already know the month-to-month loan instalment that you will need to spend without fall short. So, it keeps you perfectly geared up for that loan repayment.

Any time you consolidate your debt, you basically consider out a loan to mix your debts into a person single payment. This sounds like a good suggestion until finally you know that it really extends the duration of one's loan, meaning you’re in debt for way lengthier. Also, most often, the desire price even now depends on your credit score.

Working with debt settlement companies, occasionally known as debt aid or debt altering companies, might be risky.

Balance transfers entail going debt from a single credit card to a different. Consolidating debt could make payments extra manageable, especially if a fresh card has a reduced annual percentage charge (APR).

The settlement stays on your own credit report 7 a long time from if the account to start with grew to become delinquent.

“We can easily naturally assistance with the budgeting method and pondering, you know, other feasible ramifications,” states Thomas Nitzsche, senior director of media and brand name at Funds Management Worldwide, a nonprofit credit counseling agency.

Homeowners coverage guideHome insurance plan ratesHome insurance policy quotesBest home insurance companiesHome insurance plan guidelines and coverageHome insurance plan calculatorHome insurance policy assessments

Very best IRA accountsBest on the web brokers for tradingBest on line brokers for beginnersBest robo-advisorsBest solutions investing brokers and platformsBest buying and selling platforms for day trading

This, put together with the dearth of market reforms, causes it to be much easier for buyers to inform if a Sebt Settlement company is legit – and in order to avoid people that aren’t.

four. Get ready to negotiate. As you’ve completed your investigate and put aside some dollars, it’s time to determine what your settlement supply might be. Usually, a creditor will agree to just accept forty% to 50% with the debt you owe, Whilst it may be as much as 80%, based on no matter if you’re working with a debt collector or the initial creditor.

No immediate major purchases: Considering that Debt Settlement generally has negative outcomes on an individual’s credit score, it’s finest not to program on creating large buys right until a calendar year or two once the settlement has long been Debt settlement credit card done.

Whether you want to spend much less interest or earn much more benefits, the appropriate card's in existence. Just respond to some issues and we will narrow the try to find you.

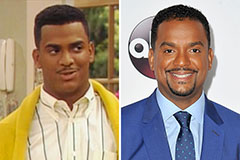

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now!